Foreclosed homes for sale in the USA present an exhilarating opportunity for savvy buyers looking to invest in property at lower prices. These homes, reclaimed by lenders due to unpaid mortgages, often come at a steep discount compared to traditional listings. With rising foreclosure rates, now is the perfect time to explore the potential benefits and risks involved in purchasing these properties.

Are you ready to sell your home? Discover essential home selling tips for US homeowners that will help you maximize your property’s value and attract the right buyers. From staging to pricing, we’ve got you covered for a successful sale in today’s competitive market!

Understanding the foreclosure process and its implications is crucial for prospective buyers. By diving into statistics and trends, coupled with success stories from previous buyers, you can grasp the unique advantages of this alternative market. Let’s embark on a journey to discover the ins and outs of foreclosed homes and how they can pave the way for your real estate success.

Overview of Foreclosed Homes: Foreclosed Homes For Sale In The USA

Foreclosed homes represent a unique segment in the real estate market, characterized by properties that have been repossessed by lenders due to the owner’s failure to make mortgage payments. Unlike traditional home sales, which involve willing sellers and buyers, foreclosures are the result of a legal process aimed at recovering the balance of a loan from a borrower who has stopped making payments.The foreclosure process generally begins when a homeowner defaults on their mortgage payments, leading the lender to initiate legal proceedings to reclaim the property.

This process can significantly impact the homeowners involved, often leading to emotional distress and financial hardship. In the USA, foreclosure rates have fluctuated over the years, with recent statistics indicating a notable increase in the number of foreclosures as interest rates rise and economic conditions shift.

Taking the plunge into home ownership? Explore exciting opportunities with first time home buyer programs in the US. These programs offer valuable resources and financial assistance to help you navigate the buying process and turn your dream of owning a home into reality!

Benefits of Buying Foreclosed Homes

Purchasing foreclosed properties offers numerous advantages for savvy buyers looking to invest in real estate. The primary benefits include:

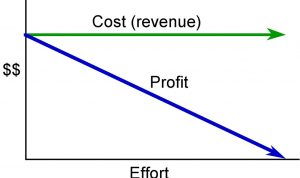

- Cost Savings: Foreclosed homes are often sold below market value, providing buyers an opportunity to acquire properties at a lower price point.

- Investment Potential: Investors can capitalize on the potential for substantial returns by renovating and reselling these properties.

- Success Stories: Many buyers have successfully transformed foreclosures into profitable ventures. For example, a couple purchased a foreclosed home in a desirable neighborhood for 30% less than market value and sold it after renovations for a significant profit.

Risks and Challenges, Foreclosed homes for sale in the USA

While there are clear benefits to buying foreclosed homes, there are also inherent risks associated with this type of investment. Key challenges include:

- Property Condition: Foreclosed homes are often sold “as-is,” which means buyers must be prepared for potential repairs and renovations.

- Legal Complications: Issues such as liens or unresolved legal disputes can complicate ownership and resale.

- Mitigation Strategies: Conducting thorough inspections and working with knowledgeable real estate agents can help minimize these risks.

How to Find Foreclosed Homes

Identifying foreclosed homes can be straightforward if you know where to look. Various resources and platforms can aid in the search:

- Government Listings: Websites like HUD.gov and FHFA.gov provide information on federal foreclosure listings.

- Real Estate Websites: Online platforms such as Zillow and Realtor.com often list foreclosures alongside traditional sales.

- Foreclosure Auctions: Local county websites or auction houses often host foreclosure sales, which can be navigated with a step-by-step approach that includes pre-registration and understanding auction terms.

Financing Options for Foreclosed Homes

Financing foreclosed properties involves various options tailored to different buyer needs. Buyers can choose between:

- Conventional Loans: Standard mortgage options are available for many homebuyers.

- Specialized Loans: Some lenders offer loans specifically for foreclosures, which may include renovation funds.

- Funding Tips: To secure funding, buyers should prepare detailed financial documentation and consider working with lenders experienced in foreclosure transactions.

The Buying Process

The process of purchasing foreclosed homes involves several critical steps:

- Pre-Approval: Obtain mortgage pre-approval to understand your budget.

- Documentation: Gather necessary documents, including proof of income, credit history, and identification.

- Checklist for Buyers: Create a checklist that includes property inspections, financing arrangements, and an understanding of local foreclosure laws.

Renovation and Resale Considerations

Assessing renovation needs for foreclosed homes is vital for maximizing property value. Consider the following strategies:

- Budgeting: Allocate a realistic budget for renovations based on property condition and market trends.

- Value Maximization: Focus on high-impact renovations that will appeal to potential buyers, such as kitchen upgrades and curb appeal enhancements.

- Marketing Strategies: Utilize modern marketing techniques to effectively promote renovated properties and attract buyers.

Regional Variations in Foreclosures

Foreclosure activity varies significantly across different states in the USA, influenced by local market conditions. Notable points include:

- State Comparisons: Some states experience higher foreclosure rates due to economic challenges, while others may see stable or declining rates.

- Market Conditions: Local economic factors, such as job growth and housing demand, play a crucial role in determining the availability and pricing of foreclosed homes.

- Trends and Forecasts: Real estate analysts provide insights into future foreclosure activity, which can guide potential buyers in their decisions.

FAQ Compilation

What are foreclosed homes?

Foreclosed homes are properties that have been repossessed by lenders after the homeowner has failed to make mortgage payments.

How do I find foreclosed homes?

You can find foreclosed homes through real estate websites, government listings, and local real estate agents specializing in foreclosures.

What financing options are available for foreclosures?

Options include conventional loans, special foreclosure loans, and government-backed loans tailored for foreclosed properties.

Are there risks in buying foreclosed homes?

Yes, risks include property condition issues, potential legal complications, and unexpected repair costs.

How can I mitigate risks when buying a foreclosed home?

Unlock the future of mobile technology with the latest Samsung Galaxy deals. Experience stunning designs, high-performance features, and advanced camera capabilities that elevate your smartphone experience. Don’t miss out on the opportunity to upgrade your device and enjoy incredible savings today!

Conduct thorough inspections, research the property history, and work with real estate professionals to navigate legal complexities.